Apple takes a recurring commission (typically 15%) from subscriptions made on its devices.

While Apple sells its own subscriptions such as Apple Music, which had over 50 million subscribers as of May, the company has noted that overall paid subscriptions made on its platforms as of October stood at 330 million, marking a 50% year-over-year increase.

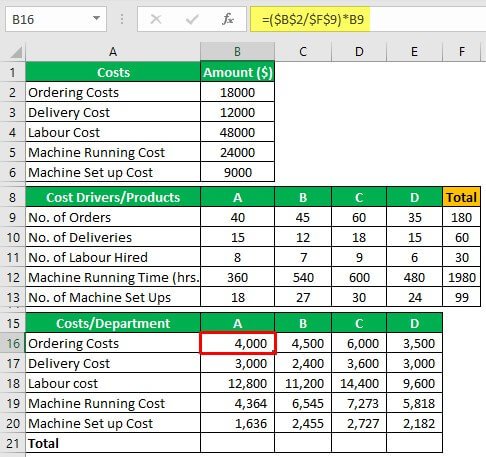

#Cost drivers examples in service industry driver

Subscriptions could be another big driver of the services business.

Apple has indicated that licensing was a major contributor to sales growth in its Services segment last year. This itself would account for nearly 25% of Apple’s total Services revenues for the year, and it’s likely that these revenues are almost pure profit for Apple, since there are no direct expenses involved. Goldman Sachs estimates that these fees – which Google dubs traffic acquisition costs – stood at roughly $9 billion in FY’18. While Apple receives licensing payments from various third parties, a bulk of the revenues likely come from search behemoth Google, which pays Apple to be the default search engine for Siri and the Safari browser on Apple devices. Licensing Could Be The Second Largest Contributor If we assume that the growth rate stood at 20% for 2018, App Store revenues would stand at about $13.5 billion, accounting for about 36% of total Services revenue. Since Apple typically splits the revenues from the App Store on a 70%-30% basis, this would imply that Apple’s share of revenues stood at $11.35 billion. Over CY’17, Apple noted that its developers earned $26.5 billion from the App Store, marking a 30% year-over-year increase. The App Store likely remains the biggest driver of Apple’s services revenues.

App Sales Are Likely The Biggest Driver Of Services Revenue

0 kommentar(er)

0 kommentar(er)